Our Story

We are a retired teaching couple who until recently worked at our dream job. In our early thirties we had $48,000 of student loan debt and both of our cars were kaput. Financially, it has been all uphill ever since. Along the way we have had many adventures, an incredible son, and lots of fun.

Our journey to financial independence began with a teaching stint in Saudi Arabia in 1996. I took a job teaching ESL while my future wife finished her M.B.A. I had just finished my M.B.A. and M.A.T.L. and was eager to start earning some money. In my five years in Saudi Arabia, I was able to pay off our student loan debt and save $100,000. Without a doubt, our time overseas helped us right our financial ship. We slayed our student loans and laid a solid financial foundation.

In December of 2001 we moved back to the U.S. and started looking for teaching jobs. Initially, we thought that we would live and teach in Texas, but things did not go as planned. Eventually, we found jobs in LaGrange, Georgia where we lived for seven years.

Year * Savings * Net Worth

Here is a recap of our savings and net worth over the years:

2002 * $3,000 * $103,000 – Took job in Texas, but hated it...QUIT. Took job in LaGrange, GA and began teaching extended day. Opened a Vanguard IRA account.

2003 * $30,000 * $135,000 – Started fully funding our 403b accounts at TIAA-CREF and our IRAs at Vanguard. Spent month of June in Brazil!

2004 * $32,000 * $165,000 – Big year...bought a home and two reliable used cars; began graduate school for Ed.S. degree. Maxed out our 403b and IRA accounts.

2005 * $50,000 * $220,000 – Maxed out our 403b and IRA accounts; also maxed out my 457 account. Wife started her Ed.S. degree.

2006 * $55,000 * $285,000 – Our son was born! Completed my specialist degree. Maxed out our 403b and IRA accounts; also maxed out my 457 account. Opened and maxed out a Coverdell Educational Savings Account for son at Vanguard.

2007 * $62,250 * $340,000 – Wife completed her specialist degree. Maxed out our 403b and IRA accounts; also maxed out my 457 account. Wife opened a 457 account. Opened Georgia 529 plan; funded at $25 a month.

2008 * $56,550 * $390,000 – Maxed out our 403b and IRA accounts; also maxed out my 457 account.

2009 * $64,395 * $450,000 – Big year...in August we took awesome jobs in Echols County, Georgia.

2010 * $84,773 * $545,000 – Fully funded every account available: 403b, 457, IRA, and Coverdell ESA. School district also funded a retirement annuity for both of us.

2011 * $85,150 * $655,000 – Fully funded every plan available to us. Hardcore savings by front-loading retirement accounts is magical!

2012 * $91,117 * $700,000 – Fully funded every plan available to us. Left job at Echols County, took and quit job in LaGrange. Wife took job in LaGrange. We opened a health savings account to use with our HDHP.

2013 * $78,422 * $785,000 – Started 72t distributions to provide income, took job for 4.5 months in neighboring county, and paid off all credit card debt. In June, we began our year off.

2014 * $46,075 * $865,000 – Continued year off with trip to Cancun, Mexico and in August took another "crappy" job in rural south Georgia (Douglas, GA). Loaded up our various accounts: $25,020 in 457 accounts, $12,000 in IRA's, $6,550 in HSA, $2,485 in ESA, 529 and UTMA accounts. All in all, not bad for only 5 months of work!

2015 * $106,250 * $900,000 – Enjoyed our jobs in Douglas, GA where we saved an average of $8,000 a month.

2016 * $93,080 * $1,000,000 – From January to August, we contributed: $48,00 to our 457 accounts, $27,698 to our 403b accounts, $6,722 to our IRAs, $5,062 to our HSA, $2,600 to our son's ESA, UTMA, and 529 accounts, and $3,000 to our mutual fund. Finally passed the 7-figure mark!

2017 * $3,200 * $1,157,493 – Fully funding ($2,000) to our son's ESA via travel hacking. We're also adding $65 a month to our VTSAX mutual fund and $35 a month to son's UTMA account (VASGX). We didn't save much money in 2017 because we were enjoying ourselves in Merida, Mexico.

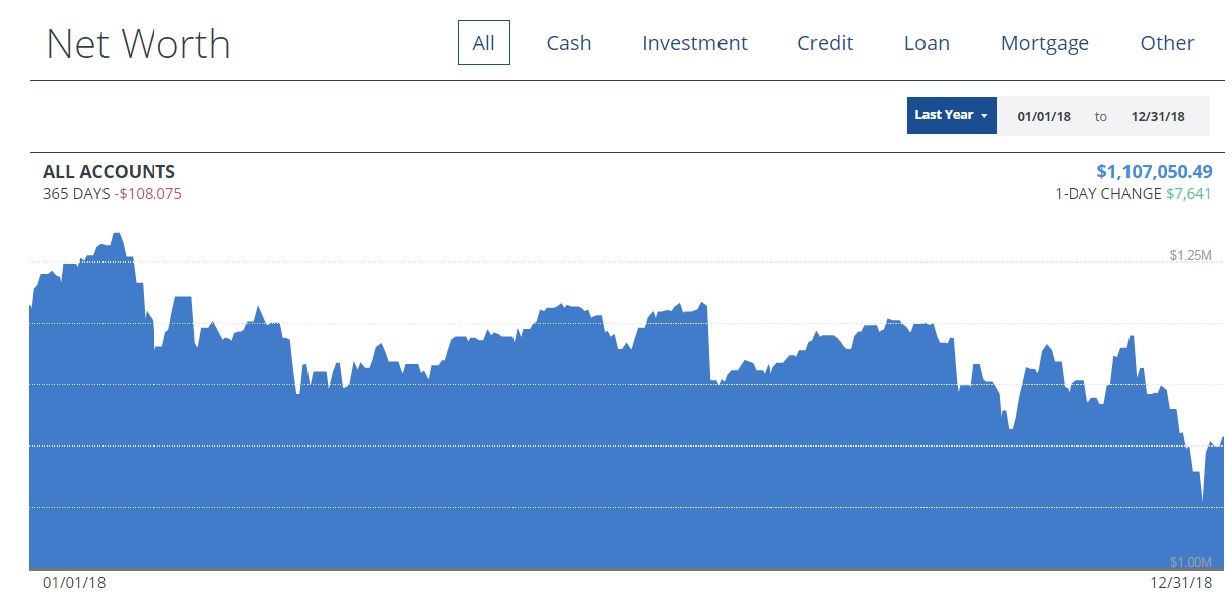

2018 * $58,499 * $1,107,050 – Funneled $43,500 to our 457 accounts and $1,000 to our 403b accounts; employer also made $2,855 of 403b contributions. Also will partially fund our IRA ($8,511) and HSA ($2,633) accounts. Net worth was down from 2017 due to a moody Mr. Market.

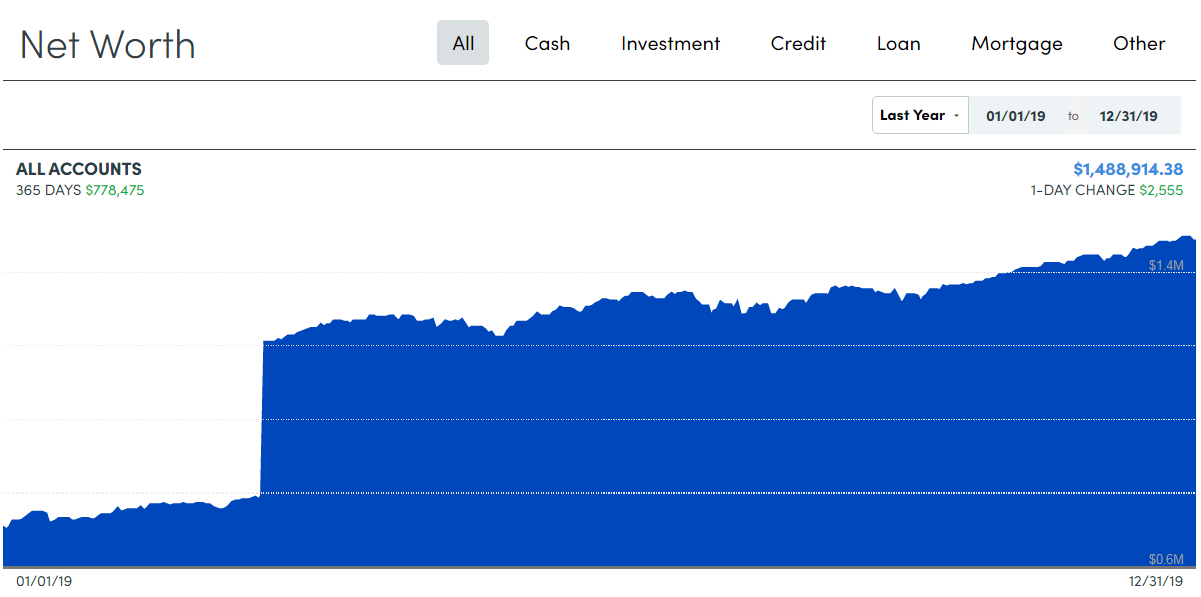

2019 * $130,059 * $1,488,914 – We fully funded every account available to us: 457 ($25k *2), 403b ($25k * 2), IRA ($7k * 2), and HSA ($8k). Plus, we also had employer 403b contributions of about $7,059. Finally, we added $1k to our VTSAX mutual fund. Our biggest year yet!

2020 * $119,063 * $1,856,778 – Wife stopped teaching in May and received paychecks until September. We filled our buckets as best we could: 457 ($26k *2), 403b ($26k + $16k), IRA ($7k + $3.5k), and HSA ($8.1k). Plus, we also had combined employer 403b contributions of $6,463. All in all, another banner hardcore savings year!

2021 * $62,200 * $2,180,000+ – Final year of teaching at Echols County High for me while my wife did not work: $26k in 457, $18k in 403b, $9k in IRAs, and $9,200 in HSA.

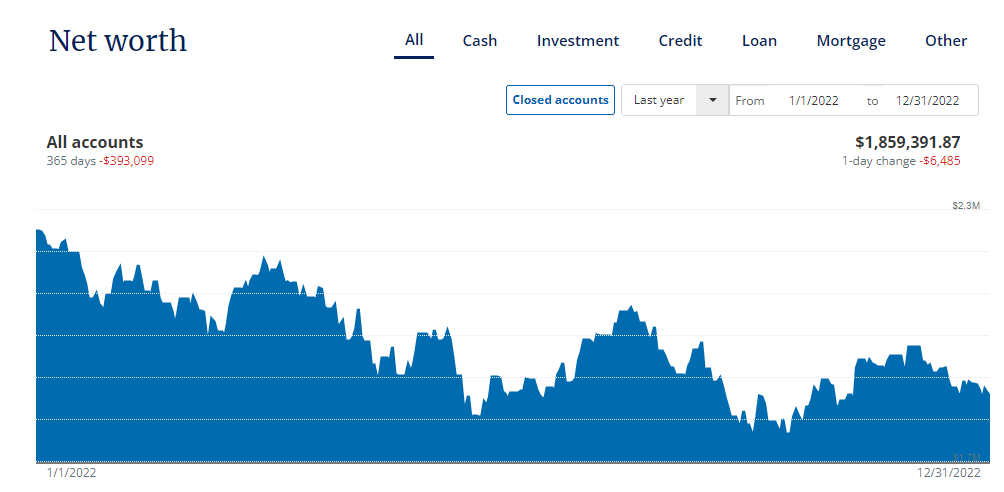

2022 * $18,200 * $1,859,000 – My wife and I did a little substitute teaching and worked on our side hustles: $8,900 in IRAs, and $9,300 in HSA.

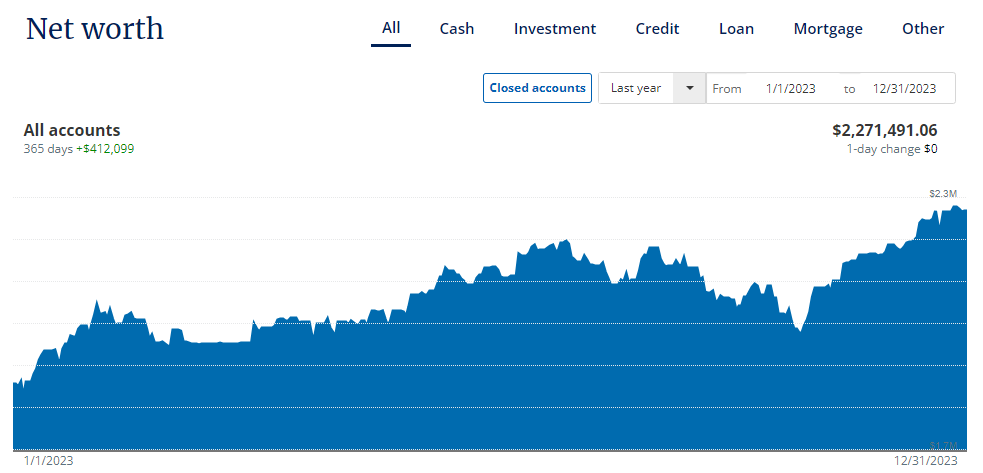

2023 * $9,700 * $2,271,000 – No "real" work in 2023 other than a little substitute teaching, blogging and our credit-tradeline side hustle. We did manage to fully fund our HSA accounts for the year. Since our wealth is now over the $2 million mark, this concludes our net worth updates. Thanks for following our journey!

The annual savings numbers above are very accurate; the net worth totals are estimates. Somewhere along the way I also opened a UTMA account for my son; it is included in the net worth totals.

Like what you're reading? If so: