10 Reasons We're Not "Real" Millionaires

"Okay, so maybe we're faux millionaires or millionaire wannabes...we're living a lie!"

¡Saludos a todos! For most people, the word "millionaire" conjures up a mental image of a hot shot living a flashy lifestyle with big cars, bigger homes, fancy gourmet meals, endless travel, and pockets hemorrhaging $100 bills. As crazy as that image might sound, for many individuals that's the life of a "real" millionaire. When my wife and I crossed over to millionaire status last year, we were both excited to finally hit our seven-figure goal. However, at no point did we ever consider "living large" just because we were now "rich."

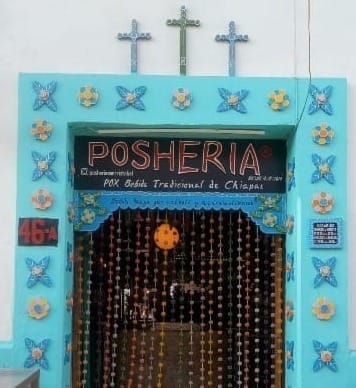

Instead of ramping up our spending and consumption, we moved to Mexico and continued to live frugally. Overall, it has been a great decision for us: costs are low, quality of life is high, our life options seem unlimited, and we're experiencing lots of adventure and personal growth. However, I can sense that many relatives and friends are perplexed by our unorthodox millionaire ways. That got me thinking about how our millionaire lifestyle does not square with most people's millionaire assumptions. Here are ten reasons why we aren't "real" millionaires:

1. Millionaire Household

My wife is not a millionaire and I'm not one either. Instead, we're equal members of a millionaire household which simply means that our combined assets are over $1 million. Said another way, we're both half-millionaires. Okay, so maybe we're faux millionaires or millionaire wannabes...we're living a lie! While being a member of a millionaire household isn't as impressive as being a millionaire individually, it'll have to do for now.

2. 99% of Our Wealth is Trapped in Tax-Favored Accounts

The majority of our money (99%) is tied up in tax-favored accounts: IRA, 457, HSA, Coverdell ESA, UTMA, and 529. All of those funds have stipulations that would trigger fees, penalties, and taxes if we were to take income distributions from the accounts. For example, if we liquidated our positions today, I'm sure that we'd lose at least 20% of our portfolio to income taxes and early-withdrawal penalties.

3. Less Than $10k in Our Taxable Accounts

The flip side of point number two is that we have less than $10k in our taxable accounts. We currently have almost $9k in our jointly-owned Vanguard VTSAX mutual fund. Other than our checking and savings accounts, that's the only money we have available to us outside our tax-favored accounts. When I think about that, I sure don't feel like a millionaire.

4. Scrawny Checking & Savings Accounts

Millionaires have big fat bank balances, right? Maybe so, but not us. We currently have less than $2k in our checking and savings accounts (check out the net worth statement above...$1,600!). We'll have to make do with those funds until we get our next IRA distribution in January of 2018.

5. No Home, No Car, No TV

Have you ever met a millionaire who doesn't own a home, car, or TV? If not, nice to meet you! We sold our home in 2015, and later got rid of both cars and our TV in 2016. We donated one car to charity and gave the other one to a relative. Later, we dropped our TV off at a Goodwill. Since we FIRE'd in September of 2016, we've rented Airbnb apartments, stayed with relatives, or lived in our apartment in Merida. Not having a home, a car, or a TV feels very unmillionaire-like.

6. Our Income Usually Ends at the 10% Tax Bracket

If you've ever read any of my "Free Money" posts, you know how we try to minimize our taxes by keeping our taxable income low. Ideally, our taxable income should end at the end of the 10% tax bracket. However, if we go beyond the 10% tax bracket, we are well aware that we enter into the 15% tax bracket. Sometimes we don't work our plan perfectly and end up paying at a 15% rate on a portion of our income. Nevertheless, the end of the 10% tax bracket is our taxable-income goal. Here are our taxable income goals over the last four years (Year * 10% Tax Bracket Income Goal * Income Tax Owed):

- 2014 * $42,400 * $810

- 2015 * $43,050 * $845

- 2016 * $43,400 * $855

- 2017 * $43,500 * $865

Do those look like millionaire income numbers to you? I didn't think so.

7. A Chunk of Our Meager Income Is a Roth IRA Conversion

In 2016 most of our taxable income was a $30k Roth IRA conversion, so actual spendable income that year was very low. (Fortunately, we had some cash from the sale of our home in 2015.) In 2017 we plan on making a $20k Roth IRA conversion which should push our taxable income up to about $55k. (So much for keeping our taxable income in the 10% tax bracket!)

However, it's important to realize that in 2017 we've lived off about $35k ($55k - $20k). Living on about $3k a month doesn't make for much of a millionaire, does it?

8. We Sometimes Live with Our Relatives

After selling our house in 2015 and moving out of our apartment in 2016, we suddenly no longer had our own place. Since we were planning on a big trip to Mexico, it didn't make sense to set up another living arrangement. Instead, we stayed with relatives in Tennessee and Georgia in between our trips back and forth to Mexico. (We've made three multi-month trips to Mexico since leaving our jobs in Douglas, Georgia in May of 2016.)

I realize staying with family is a no-go for many people, but my wife and I get along great with our extended families. Sure, there were moments when we wanted to be in our own place, but overall our stays were enjoyable. Plus, we were able to catch up with many of our relatives because we were available to visit with people (after all, we didn't have a job ruining our schedule). It was fun being boomerang millionaires!

9. We Rarely Eat at Fancy Restaurants

Eating out can be great, but it can also be very expensive. Back in our money-moron days (hat tip: Scott Alan Turner), we ate out all the time. As we became more frugal, we realized that taming our restaurant bill would require eating at home. We soon realized that we were both good cooks, so the transition was easy...plus, we suddenly had leftover meals for lunches. The more we ate our own cooking the less appealing eating out became; we both realized that we could prepare better meals than most of the restaurants we frequented.

These days we prefer to eat out at restaurants that prepare food that we can't make at home. I'll be honest, I'm always up for a good lunch buffet: Chinese, Indian, fried seafood, etc. Lunch buffets also tend to be moderately priced with fresh food. You'll never see us dropping $100 at restaurants.

10. We Don't Dress to Impress

Sweet shoes, right? It's amazing how few clothes you need when you're not working anymore. My wardrobe consists of workout clothes, shorts, short-sleeve shirts, a pair of jeans, and comfortable shoes. My wife has a similar wardrobe. Since we're simply enjoying life, we don't have to dress to impress people. Don't get me wrong, we don't walk around dressed like hobos, but our clothes would never suggest millionaire status. (Not all of my shoes look like those in the photo!)

The Big Finish

Voila, those are a few of the reasons we're not "real" millionaires. I'm sure there are other millionaires out there living a similar existence. Are you an offbeat millionaire? If yes, how so? I look forward to your comments.

Carlessly and Homelessly Yours,

Gerry

2025 Update: These days we have a car, a home, and even a TV. A lot has changed since this post: our net worth has increased, our income goes deep into the 12% bracket, and our taxes have skyrocketed 😉!