How We Saved $250,000 by Taking "Crappy" Jobs

"In the eyes of my friends, we were taking really CRAPPY jobs..."

In May of 2009, my wife and I were exhausted and in need of a change of scenery. Our teaching jobs in LaGrange had become more and more hectic and less and less enjoyable. One morning as I perused my Teach Georgia account, I came across jobs for both of us in Echols County. On a whim, I decided to apply for the jobs just to see if we might get an employment nibble.

Naturally, I started researching the area and found out that Echols County was very different from the rest of Georgia. First, the county had less than 4,200 people in its 421 square miles. Most of the economy consisted of agriculture and timber...not exactly big city living. I had always heard that south Georgia was a lot slower than the rest of the state, but at the time I did not fully understand how. Finally, Echols County was the official county of banishment for many Georgia lawbreakers.

A week later we went for our interviews, nailed them, and got new jobs. After the interview we drove around Statenville, the county seat, and quickly realized that there wasn't much to the town. It had two gas stations, a small grocery store and a small family-run restaurant with outdoor picnic tables. It also had a public library, a health department, a post office, and a few other government buildings. On the bright side, the school district had less than 800 students on its K-12 campus. Academically, the school had a private school feel.

Statenville's Lone Stoplight:

Back in LaGrange we told our friends and co-workers that we were accepting jobs in Echols County. In spite of being life-long Georgia residents, most of them had no idea where Echols County was. As I described the county to them, I could tell many of them thought we were crazy to head off to the sticks of south Georgia. We heard lots of questions: "What will you do for culture?" "What will you do for fun?" "Will your son be happy there?" It was obvious: in the eyes of my friends and co-workers, we were taking really CRAPPY jobs in the boondocks.

In spite of the negative vibes, we were convinced that we could make our time in Echols County worthwhile financially. Prior to officially accepting the jobs, I verified that the district offered the retirement plans necessary to complete our savings plan.

Fortunately for us, the district offered three retirement plans: a 457, a 403b and an annuity funded by the district (401a or 403a plan?). Since the district did not offer the social security plan, they paid 6% of our salary into an annuity at Valic. In addition to these three plans, my wife and I knew that we would fully fund our IRA accounts and pay into the Teacher Retirement System of Georgia. In all, we would be contributing to five retirement plans...each!

Before leaving our jobs in LaGrange, we added $33,000 to our 457 accounts to raise our combined 457 balance to $90,000. Utilizing our savings in our 457 accounts was key to working our plan since these funds can be tapped without the usual IRS pre-59.5 10% penalty (when an employee separates service). From 2010 to 2012, we took distributions averaging $30,600 a year from our 457 plans. This stream of money enabled us to go full throttle on our retirement savings.

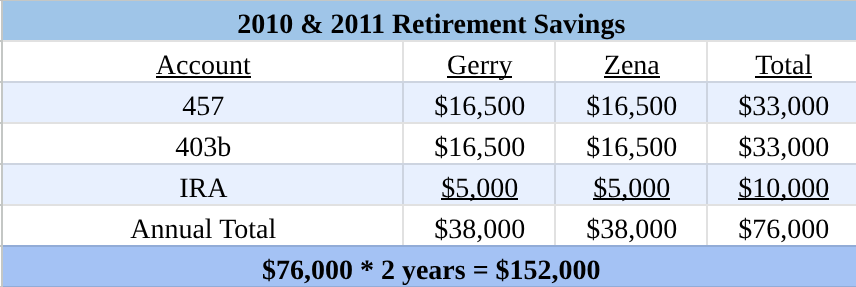

In 2010 and 2011 we fully funded our 457, 403b and IRA accounts. The district made month contributions to our annuity plan...more on that later. Here is what we saved in our first two years:

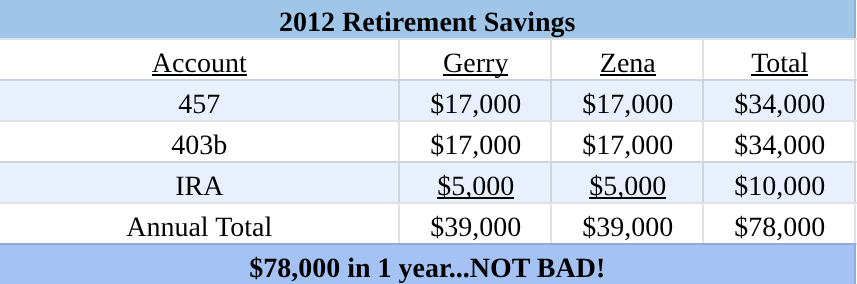

In 2012, 457 and 403b contribution limits increased by $500 per account, so we were able to save even more. Here's the breakdown:

After three years of aggressive savings, we were able to put away $230,000 in our 457, 403b and IRA accounts. During that time our district annuity plan had grown to over $20,000; what an added bonus to our overall savings!

Most of our friends and co-workers considered our move to Echols County a lateral move at best while others saw it as a journey to educational and social oblivion. In reality, it was a great experience on many levels. Financially, we did great, but we also grew professionally, had a ton of fun, and met about 4,000 great people.

I got to experience being a head coach and administrator, my wife was able to teach a new subject, and our son attended an excellent elementary school. We took frequent beach trips to Florida and Jekyll Island, visited relatives in the area, grilled out with regularity, attended wild game suppers at church, ran the Gate River Run twice, went trail running and squatching around the Alapaha river, visited the Okefenokee Swamp, ate awesome AYCE BBQ and seafood here and here, worked out more, ran more, read more thanks to Mrs. Jackie (RIP Special Lady!), and greatly improved our mental and physical health via overall stress reduction.

My Reflections in 2025: This was my first blog post that attracted eyeballs. I'm glad that I wrote it and put the numbers out there. However, at the time I didn't know my "Why of FI" and I didn't have any FIRE goals in mind. I just knew that I liked watching our net worth grow while also dramatically improving our work-life balance. We loved Echols County so much that we eventually bought a home there, and we still live there today. (At least when we're Stateside. 😉)

If this post provided you with value, inspirational or informational, and you'd like to thank me, here's my tip page. Also, if you know someone who might benefit from this post, please share it with them.