How We Saved $500,000 in 4.5 Years

"Eventually, a moment of clarity arrived... sometimes it's good to be crazy."

If you've poked around my website at all, you already know how much we like "crappy" jobs. (If you're scratching your head, read these posts: #1 and #2.) In those posts, I explained how we moved to rural teaching districts ("crappy" places in the eyes of many but not ours) where we were able to dramatically increase our net worth through a combination of hardcore savings and frugal living. To be honest, I'm a little tired of writing about those two jobs, but I realized that I haven't told the full story.

The Inside Baseball

Around March of 2009 my wife and I were doing a lot of things right financially. We were both maxing out our 403b and IRA accounts, we had a net worth around $400,000, a nice home, a modest debt load, and our spending was in check. However, one day during a spreadsheet planning session, I realized that we were squandering a golden opportunity. While we were already saving over $50,000 a year, I knew we could better optimize our financial plan.

I know some of you are thinking, "what the heck, they were saving $50k a year and he wasn't happy." Yeah, that's correct. Why? Because we should have been fully funding all six of our retirement accounts, not just four of them. In addition to our Vanguard IRAs, my wife and I both had access to a 403b and 457 plan at work. Our problem was that we never seemed to have enough money to fund our 457 plans even though we were earning about $120,000 a year.

I realized that we had a cash-flow problem. Although we made enough money on paper to fund all of our retirement accounts, our living expenses, retirement contributions, benefits, and taxes were gnawing away at our disposable income. "If only we had another $1,000 a month," I thought to myself.

Birth of THE Plan

As I looked over my spreadsheet, I saw $60,000 sitting in our 457 accounts earning 2% a year in a short-term fixed account. The money was stuck there because the fees associated with the investment platform were prohibitive: 125 basis points (or 1.25%) just to invest our own money. (Ha...no way in Hades!) Suddenly, I thought to myself, "How can I make this money useful NOW?

Then, like a thunderbolt to the head, I realized that a 457 plan allowed for pre-59.5 withdrawals without penalty as soon as you "separate service" from an employer. In other words, if we quit our jobs, we would be able to access the $60k without penalty. I also realized that we had enough time to contribute another $30k before 2010 to get our 457 balance up to $90k.

I sat and thought about the possibility of quitting our jobs to access our money. Was I crazy to even contemplate such a move? It seemed insane. After all, we taught at a good school, Zena was the Teacher of the Year, and I was a popular coach and the A.P. Spanish teacher.

But, things appeared to be trending in the wrong direction: days were becoming more stressful and less enjoyable, we always seemed to be in a rush, we each had over 140 students, Fridays were jubilant, and Sunday evenings were dreadful. (Hey teachers, can you relate to any of that?) Lying in bed, I asked my wife, "Are you happy here in LaGrange?" After a brief conversation, we agreed that our jobs were consuming our lives. I told her that I had an idea...

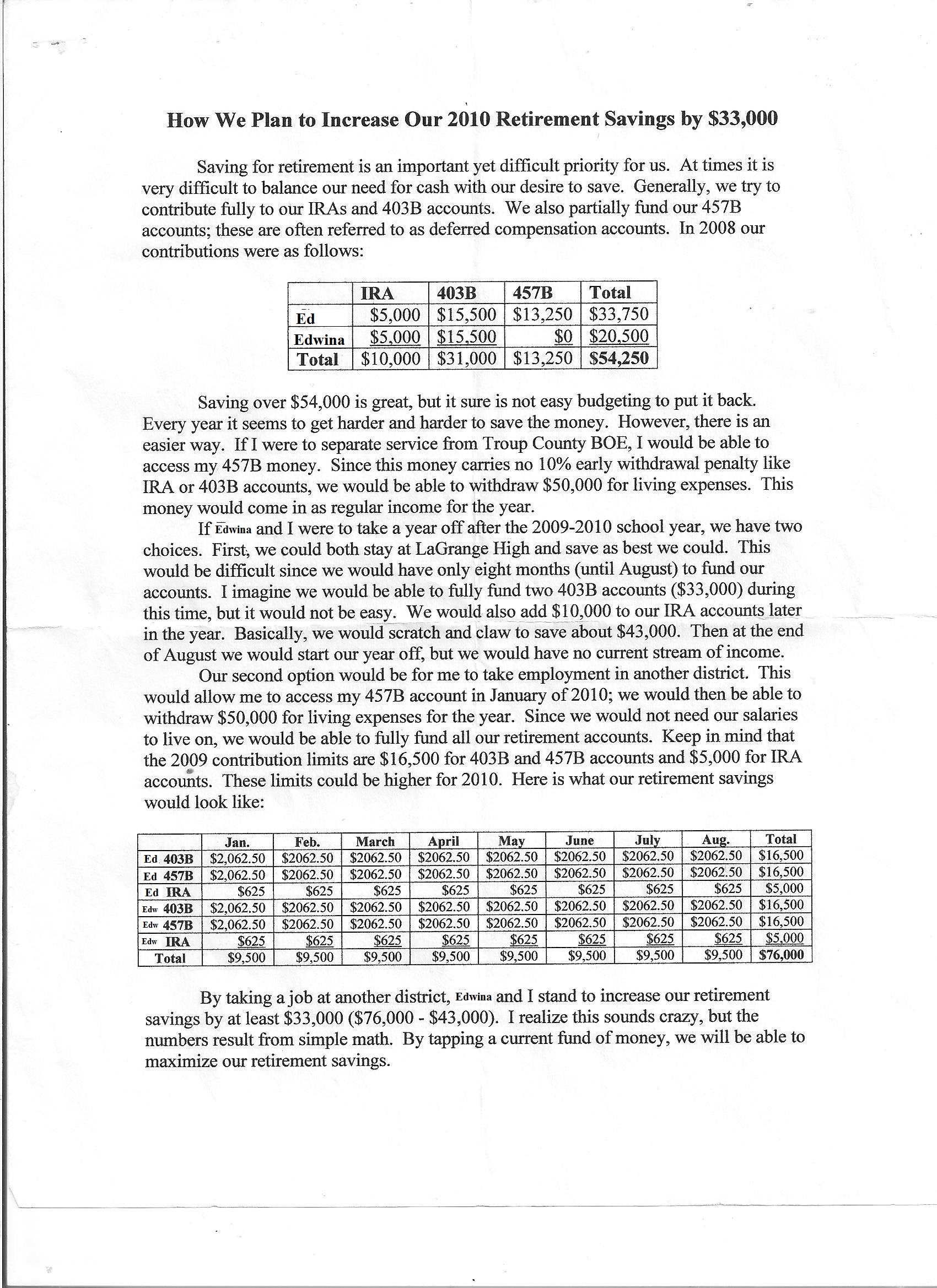

The next day in my wife's computer lab I started writing The Plan. In it I detailed the following facts:

- if we quit our jobs, we would have access to $60k

- if we increased our 2009 contribution amounts, we could get our 457 balance up to $90k

- if we started taking 457 distributions in January of 2010, the money could cover most of our living expenses

- if we found new jobs with both 457 and 403b plans, we could max out all six of our retirement accounts (403b, 457, and IRA)

- if we took yearly 457 distributions of $30k, we would have three years of living expenses

- if we maxed out our retirement savings, we would greatly increase our tax efficiency

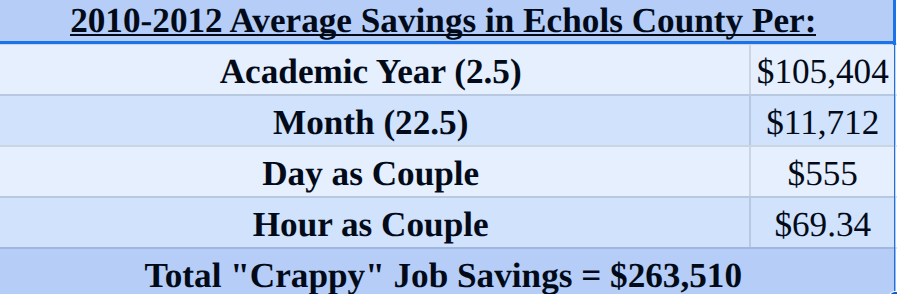

I actually wrote a couple of versions of The Plan over the course of the week. As soon as I finished writing a version, I would print it off and submit it to my wife. Thankfully, she read them and she became receptive to the idea of us quitting our jobs and taking new jobs in another school district. Here is an early version of The Plan that I found in an old notebook:

Execution of The Plan

Once we realized the benefits of quitting our jobs, it was my job to find our next teaching gig. After monitoring the Teach Georgia website for about a month, I found our first "crappy" job location in Echols County.

In May we quit our jobs and began preparing for our move to Statenville. In July we got settled into a rental house, and in August we began teaching at Echols County High School. We immediately recognized our good fortune: the people were nice, we had fewer students (I went from 142 student to 41!), and the quality of life was better.

The job was also better financially: we were exempt from Social Security tax (yes, you read that correctly) and we had a "replacement" retirement plan instead of Social Security. It was beautiful; the normal 6.2% Social Security deductions were absent from our paychecks while our employer contributed 6% to the district's replacement plan. To top it off, we were 100% vested in those contributions from day one!

After a great fall semester, we made it to January of 2010--it was time to execute The Plan! In January we took our first 457 distribution (from our previous employer--not the new one!) so that we would have money for our living expenses. At that same time, we contributed 100% of our paychecks to our 403b and 457 accounts. Over the year, we pulled funds from our 457 accounts when we needed money for our living expenses. This allowed us to live a nice lifestyle while saving a lot of money.

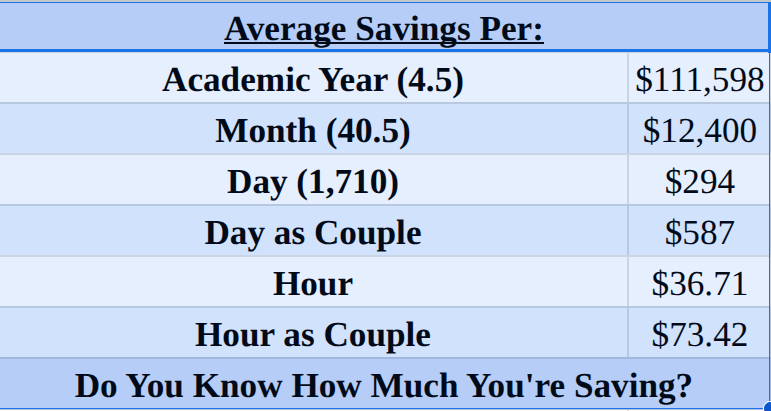

From 2010 to 2012 (2.5 academic years), we repeated this process and it enabled us to save $263,510 (see table below). In the spring of 2012, we left Echols County to take a break from teaching. Over the next two academic years, my wife taught for one year and I taught for five months. We took the entire 2013-14 academic year off (not a sabbatical, "off" as in with NO job).

In 2014, we decided to look for another "crappy" job so that we could grow our net worth to $1 million and possibly never have to work another "real" job again. Once again, I monitored the TeachGeorgia website and eventually found jobs for us in Coffee County, Georgia. Lather, rinse and repeat...

In July of 2014, we moved to Douglas, Georgia to perform more of our hardcore-savings magic. For our living expenses we drew from two sources of income. First, we had our 457 plans from our previous jobs in Echols County. Second, in 2013 we began taking 72t distributions from our IRA accounts at Vanguard. These two sources of income easily allowed us to go full throttle on our retirement savings.

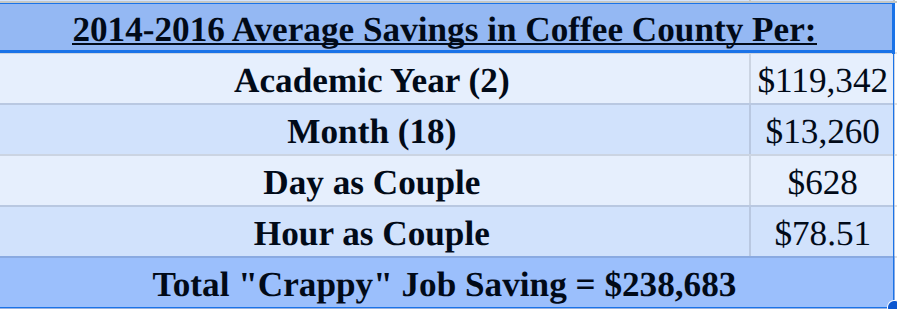

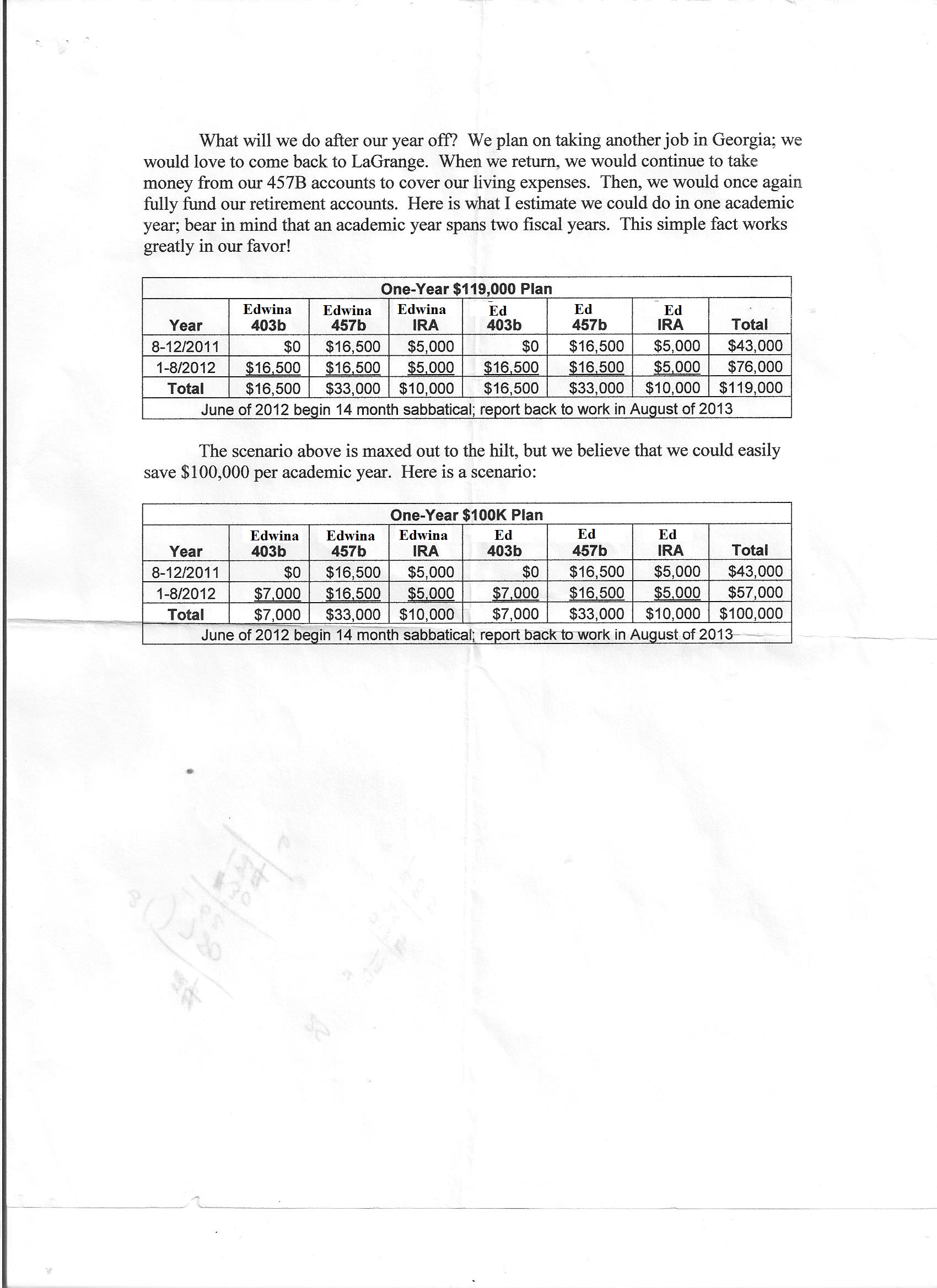

After two years of living frugally and saving like crazy, we were ready for another break, so we called it quits again. In our two academic years in Coffee County, we saved $238,683. The grand total for our 4.5 academic years in Echols County and Coffee County was an astounding $502,193. (Hey, I'm from a working-class background, so a half million is big money to me! Most days I still can't believe we did this.) Check out our numbers below:

The categories in the table above contained the following accounts:

- Retirement * This category includes our 457, 403b, and traditional IRA accounts. You'll notice that the 2012 balance is very large. That year we rolled our district annuity (in lieu of Social Security!) over to our Vanguard IRA accounts. We each had a little more than $10,000 in those accounts.

- Family Money * This category includes our Health Savings Account and a taxable mutual fund. We opened our HSA in 2012 when we began using a high-deductible healthcare plan (HDHP).

- Son's Money * This category includes my son's various accounts: a Coverdell educational savings account (ESA), a UTMA account, and a 529 college savings plan.

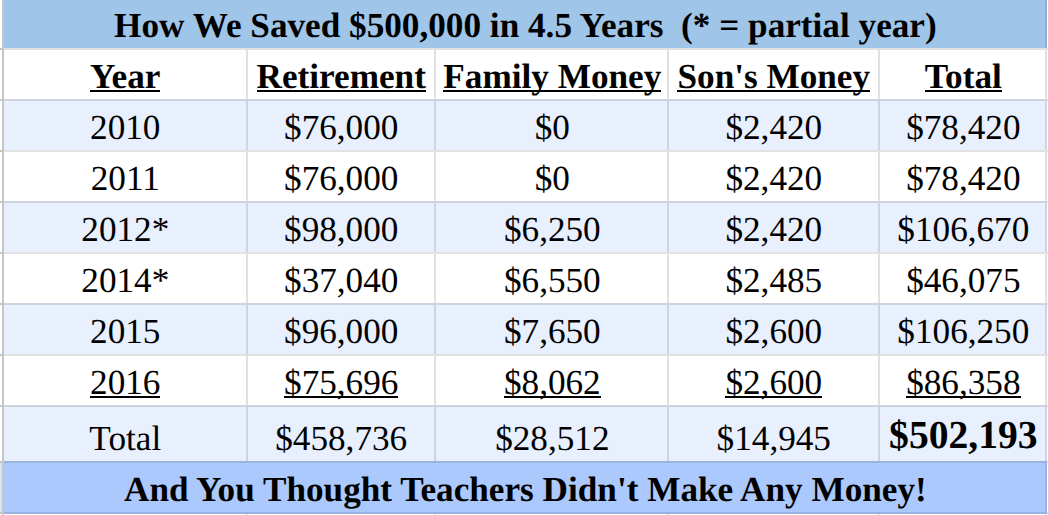

Here are some averages for our five years of hardcore savings. (Since my last job had 5 weeks and 3 days of holidays and breaks, I considered the school year to be nine months long for the monthly calculation.) Knowing our savings averages served as a constant motivator as we worked towards our savings goals. A bad day is soon forgotten when you realize that you just saved over $500. A bad month at the job? Oh well, we still saved over $12k! Keep in mind, that is money SAVED, not earned before taxes.

How to Build Your Own $500,000 Savings Plan

Flip Your Thinking * Okay teachers, I love and appreciate all that you do, BUT too many of you view teaching as taking a vow of poverty. That kind of thinking ensures that you will always be poor; it's called a self-fulfilling prophecy. What if you flipped your thinking and viewed your teaching job as a chance to save money to "buy your freedom?"

Instead of waiting for politicians to grant you a 2% raise (before taxes) or riding out your 30-year prison term teaching career, you could simply take control of your own finances and life. I know this sounds revolutionary to many, but it can be done.

Prepare Your Cash Flow * If you have a 457 (with no surrender fees!) at your current job, you need to start feeding it now. Pretend it's starving. As in our case, your 457 distributions could cover your living expenses while you save 100% of your paycheck. We never invest in our 457 accounts. Instead, we treat them like savings accounts that will be used for our future living expenses. (Be sure that your 457 plan doesn't have surrender charges because all such fees are stolen taken from YOUR 457 account balance.)

Target Your Next Job * At some point you'll need to have your next job ready, so plan for it. While there is always an element of chance to landing a job, don't depend on luck. Monitor job vacancies in a few areas you might consider for your plans B or C. Network and ask around about potential openings in your districts of interest.

Also make sure that your potential employers offer the retirement plans you need (403b and 457); do not take a job that does not have the retirement plans that you need! Finally, I recommend that you choose an inexpensive locale where you can blow in, live frugally, and save all of your salary.

Make a Plan * Get out a spreadsheet and figure how much money you (and your family) could save if you pulled off 1, 2, or 3 years of hardcore savings. The numbers might shock you. If you lack financial planning creativity, feel free to copy my plan.

Work Your Plan * If you go through all the trouble of quitting, moving, and finding a new job, you should try to suck it up for at least two years to make your plan work. Don't Lose Your Nerve. If your new job is terrible, keep in mind that you'll be leaving as soon as you have $50,000 or more. It's a great motivator when you understand how much you're saving. Know your average savings by: academic year, month, day and hour. You should always know what you're trying to accomplish.

Final Thoughts

Okay, now you all know just how crazy I am. Back in 2009 I had a lot of crazy questions running through my mind. "Why can't we max out six retirement accounts in addition to our pension?" "Why can't we save over $10,000 a month or $100,000 a year?" Instead of ignoring these "crazy" questions, I opened up a spreadsheet and a Word document, and I began exploring various options in hope of achieving my financial vision. Eventually, a moment of clarity arrived and showed me the way. Sometimes it's good to be crazy.

Obviously, my quirky retirement planning is not for everyone, but I am certain my approach will appeal to someone reading this. If you're a fellow crazy teacher looking to save a lot of money fast, just know that it can be done. You'll have to do some unconventional things (like quit your job and move to the Hinterland), but it might greatly accelerate your wealth-building plan. If you know of someone who might benefit from this approach, do me a favor and please forward this post to them.

What do you think about our unorthodox approach? Are we crazy? Could you craft a similar radical hardcore-savings plan to ramp up your wealth building? I look forward to your comments and questions.

Bonus Tables for the Bored and Nerdy

Hey guys, sorry to dump these here, but I know some of you like tables as much as I do. Here are our "crappy" job savings averages by location. First, here are our averages during our time in Echols County, Georgia from January of 2010 to May of 2012.

Next, here are our averages during our time in Coffee County, Georgia from August of 2014 to May of 2016.