Tax Planning: 2025 Free Money!

"I'm still NOT a CPA, accountant, or tax professional. Truth be told, I struggled in my accounting classes that I had to take for my MBA. Like you, I'm a normal person trying to make sense of our infinitely complex U.S. tax code."

Greetings old friends and new readers! It's that time of year again--it's time to start preparing for next year's federal income taxes. In other words, it's time for my annual Free Money! blog post. This is the one blog post that readers actually inquire about without fail. For that reason, I'll probably have to write an updated version of this post every year until death. So much for slinking off to retirement!

Our Former Child-Tax Credit Is Off to College!

As I mentioned last year, our son (aka, our former tax credit) no longer provides us with much tax-planning utility. From a child-tax-credit perspective, he's useless. That said, we still love him immensely!

What is Free Money! Exactly?

Free Money! refers to the amount of income:

you can earn before you owe any federal income tax.

FM! represents your 0% tax rate for your federal income taxes (not your state or FICA tax rate). The FM! calculation for most people consists of two components: 1.) the standard deduction and 2.) the child tax credit. (However, keep in mind that once your adorable child tax credit turns 17, that credit is gone forever.)

Free Money! Components Recap

The standard deduction depends on the filing status of the taxpayer; here are the 2025 numbers:

- Single * $15,000

- Married Filing Separately * $15,000

- Head of Household * $22,500

- Married Filing Jointly * $30,000

The child tax credit provides a tax credit of:

- $2,000 per child (ages 0-16)

- the income value of the credit depends the taxpayer’s tax bracket (e.g., 0%, 10%, 12%, etc.)

Before I go any further, be forewarned…

Newsflash: I’m Still No Tax Expert!

Okay, here’s my annual disclaimer. I'm still NOT a CPA, accountant, or tax professional. Truth be told, I struggled in my accounting classes that I had to take for my MBA. Like you, I'm a normal person trying to make sense of our infinitely complex U.S. tax code. These 2025 FM! calculations are my best attempt to make informed tax decisions in 2025. (If you find any errors in my numbers, please let me know in the comments section.)

2025 vs 2024

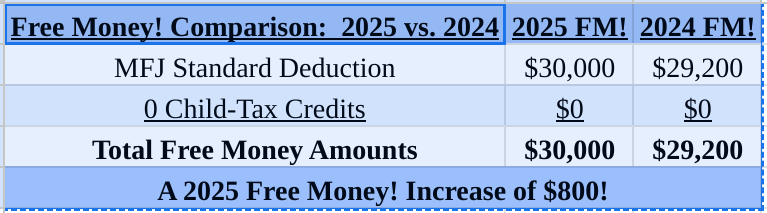

Since the MFJ standard deduction is going up by $800, there is a little good news for 2025. Here is how our 2025 FM! amount compares to last year’s amount:

Thanks to the inflationary environment that we've all been living under the last few years, we’ll probably need more than $30,000 to live on in 2025. So, now it’s up to us to decide how much we want to pay in federal income taxes. (Yes, we choose the amount; it is not chosen for us!)

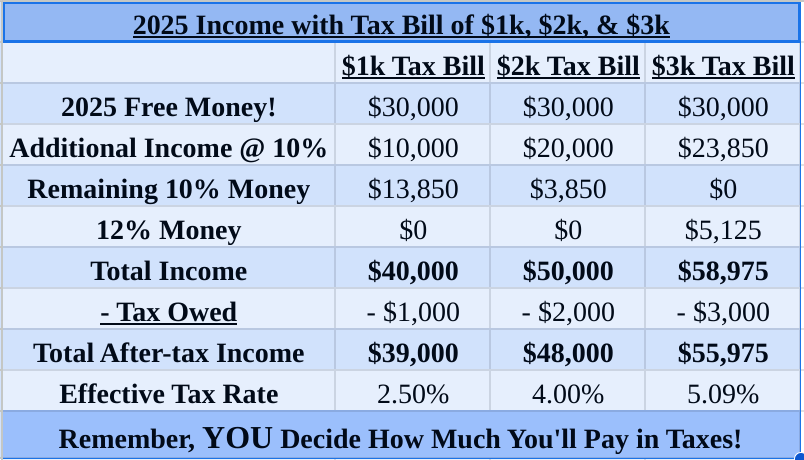

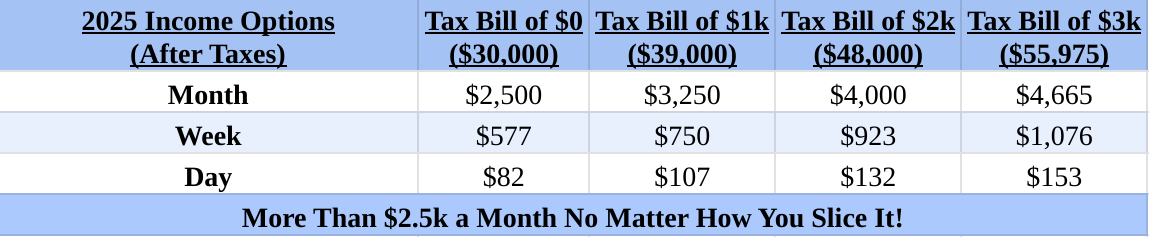

Here are our 2025 income options based on federal income taxes of $1k, $2k, and $3k:

Would you take a look at those effective tax rates! The lowest rate is 2.50% with net total income of $39,000 while the highest rate is 5.09% with a net total income of $58,975. Those are decent amounts of income with very small tax bites. (Those income amounts would go a long way here in Mexico!)

Annual "Eternal Confusion" Note: Because the 10% tax bracket for MFJ is $23,850 for 2025, the calculations are pretty easy. For the $1k example, a tax bill of $1,000 results in $10,000 of additional income ($1,000/.10). For the $2k example, a tax bill of $2,000 results in $20,000 of additional income ($2,000/.10). Finally, the tax bill of $3k yields an additional $28,975 of income ($385/.10) + ($615/.12). (If this sexy tax math confuses you, don’t feel bad because taxes are confusing to most people.)

Here’s what our 2025 income options look like after taxes:

We could live large on those amounts here in Mexico. Frugalistas Stateside who live in LCOL areas could also enjoy a nice lifestyle on the amounts above.

Final Thoughts

Now that we have our 2025 FM! tax numbers, we are ready to make informed tax decision for the upcoming tax year. As always, I have included tax tables to help my readers as they devise their own tax plan; see below.

Yours in 2025 tax preparedness,

Gerry

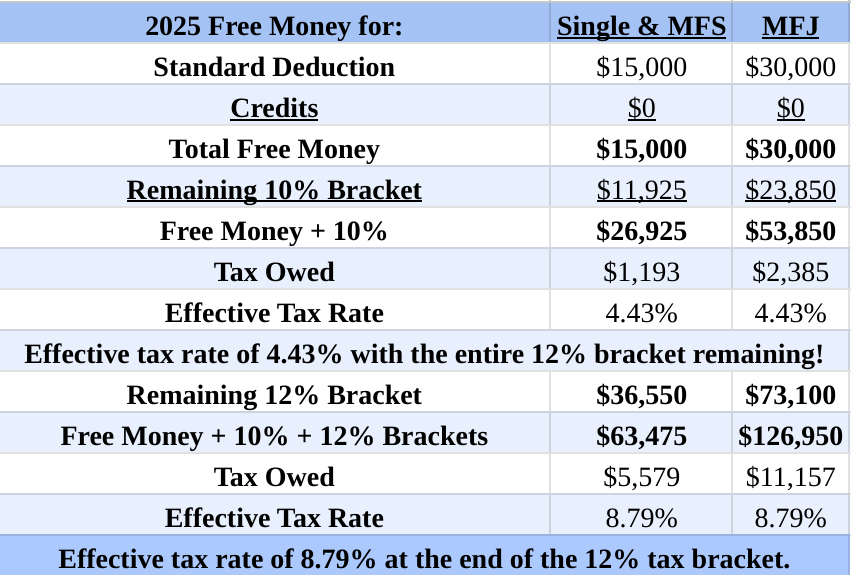

If you don’t have any children that qualify for the child tax credit and your filing status is “Single, MFS, or MFJ,” here’s your table:

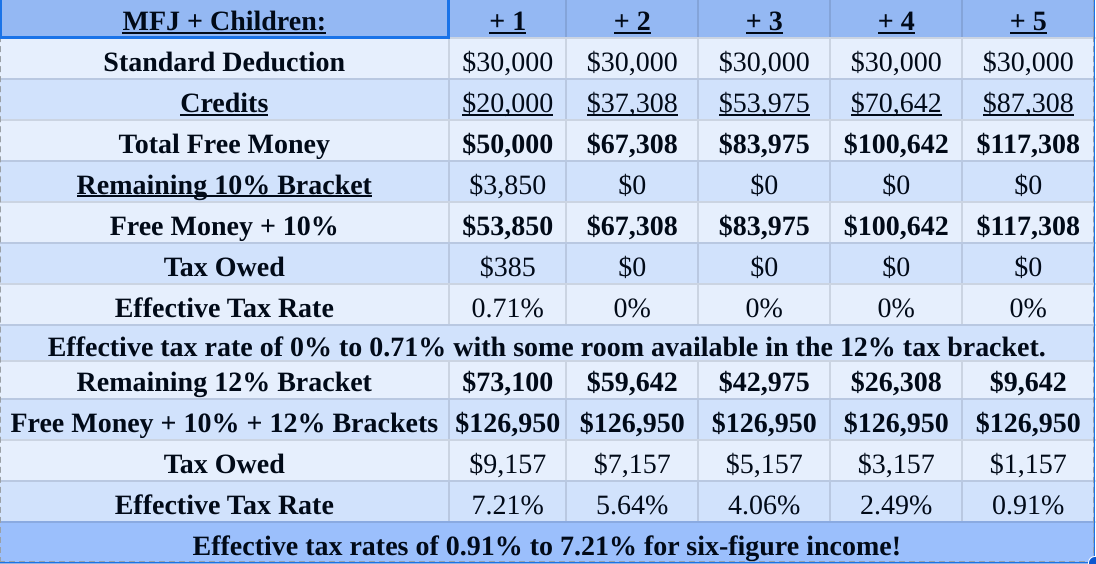

If you have children who qualify for the child tax credit and your filing status is “MFJ,” here’s your table:

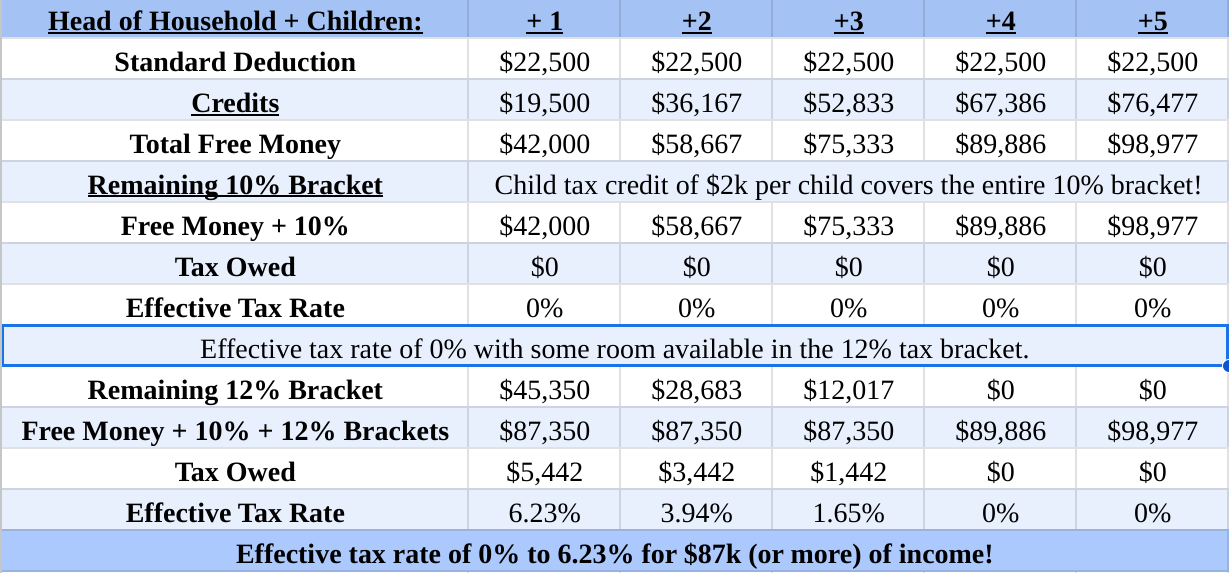

If you have children who qualify for the child tax credit and your filing status is “Head of Household,” here’s your table:

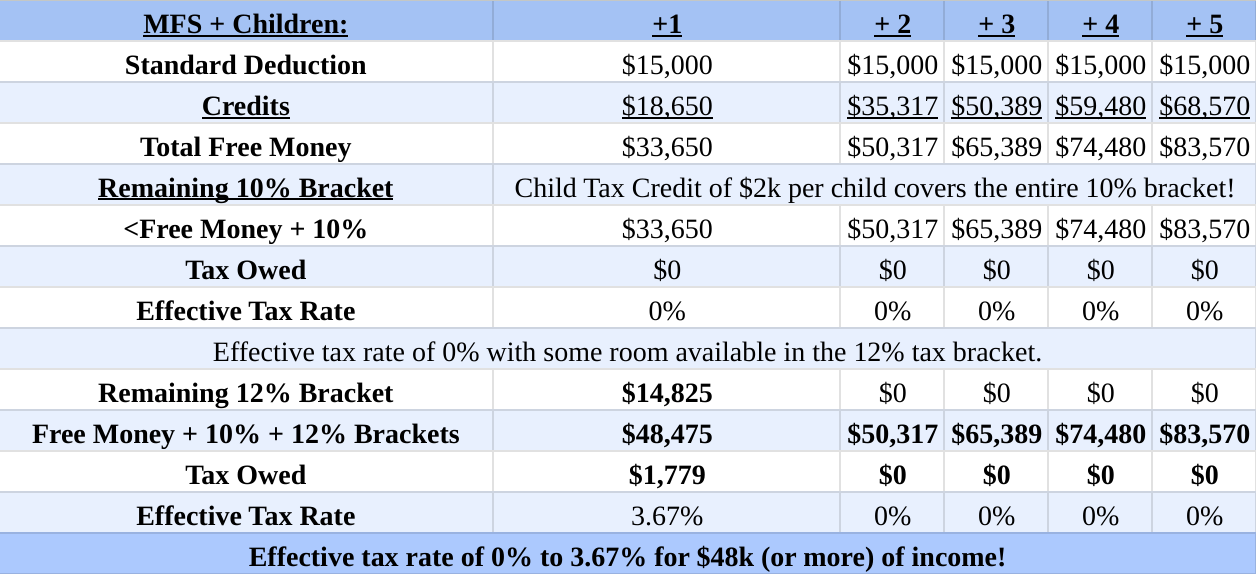

If you have children who qualify for the child tax credit and your filing status is “Married Filing Separately,” here’s your table: