Tax Planning: 2026 Free Money!

Like you, I'm a normal person trying to make sense of our infinitely complex U.S. tax code.

Warm pox greetings to all of my tax-planning friends out there. ("Pox" is a common firewater found in Chiapas, Mexico.)

Anyway, it's time for my annual Free Money! to show you how much income you can earn before you owe Uncle Sam any federal income tax.

This post will also help you determine your tax liability at the end of the 10% and 12% tax brackets. The point of this post is to remind you just how useful a basic tax plan can be.

Remember, you (not the government) should be the one deciding how much you'll pay in federal income taxes!

Free Money!, What's That?

Free Money! refers to the amount of income that:

you can earn before you owe any federal income tax.

FM! represents your 0% tax rate for your federal income taxes (not your state or FICA tax rate).

The FM! calculation for most people consists of two components: 1.) the standard deduction and 2.) the child tax credit. (However, keep in mind that once your adorable child tax credit turns 17, that credit is gone forever.)

Free Money! Components Recap

The standard deduction depends on the filing status of the taxpayer; here are the 2026 numbers:

- Single * $16,100

- Married Filing Separately * $16,100

- Head of Household * $24,150

- Married Filing Jointly * $32,200

The child tax credit provides a tax credit of:

- $2,200 per child (ages 0-16)

- the income value of the credit depends on the taxpayer’s tax bracket (e.g., 0%, 10%, 12%, etc.)

Before I go any further, be forewarned…

Disclaimer: I’m Not a Tax Expert!

Okay, here’s my annual disclaimer. I'm still NOT a CPA, accountant, or tax professional. While I had to take accounting classes for my MBA, I would never say that I had a knack for accounting, taxes, or tax planning.

Like you, I'm a normal person trying to make sense of our infinitely complex U.S. tax code. These 2026 FM! calculations are my best attempt to make informed tax decisions in 2026. (If you find any errors in my numbers, please let me know in the comments section.)

2026 vs 2025

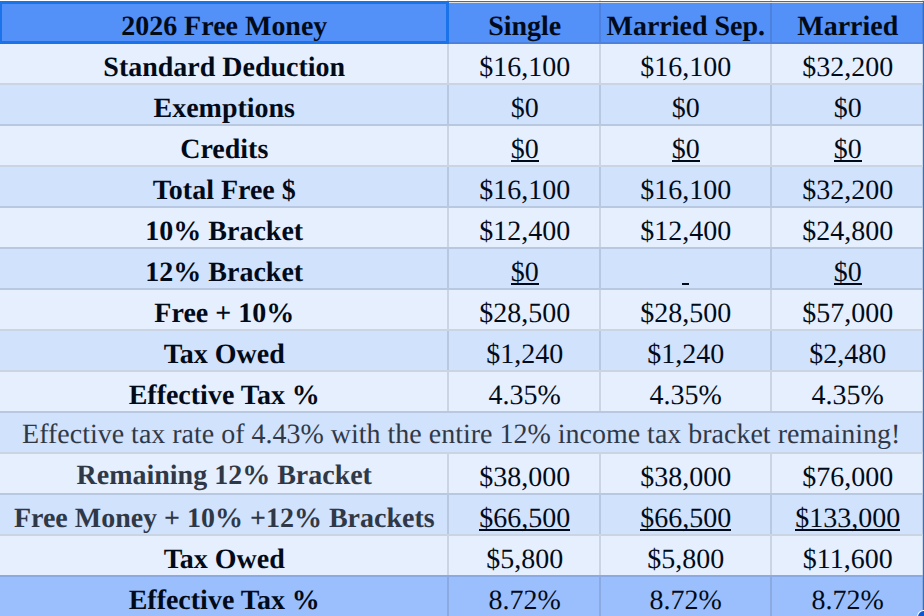

Great news! In 2026, the MFJ standard deduction will increase by $2,200. Here's how our 2026 FM! will compare to our 2025 FM!:

What does this mean for us in 2026? Simple, it means that we will be able to earn $32,200 in 2026 before we owe any federal income tax. Effectively, this is our 0% tax bracket.

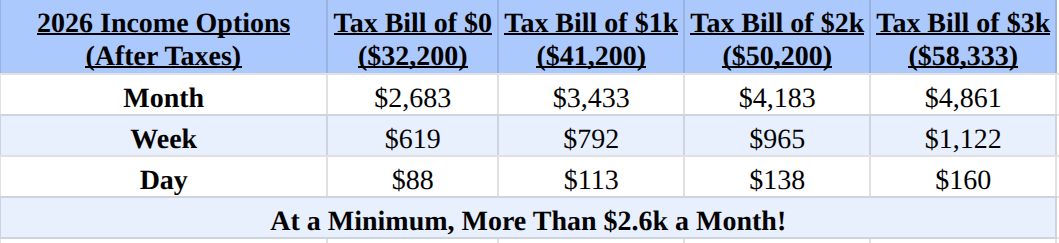

Let's say that in 2026 we would like to take more income from our sources of income (pension, IRA accounts, and side hustles), but we don't want to pay a lot of federal income tax. Check out this table to see how much income we could earn with tax bills of $1k, $2k, and $3k:

Wow, take a look at those effective tax rates of 2.37%, 3.83%, and 4.89%! Any of those income scenarios above would be more than enough for us to enjoy a nice lifestyle here in Mexico.

Annual "Eternal Confusion" Note: Because the 10% tax bracket for MFJ is $24,800 for 2026, the calculations are pretty easy:

- For the $1k example, a tax bill of $1,000 results in $10,000 of additional income ($1,000/.10).

- For the $2k example, a tax bill of $2,000 results in $20,000 of additional income ($2,000/.10).

- Finally, the tax bill of $3k yields an additional $29,133 of income ($2,480/.10) + ($520/.12). (If this tax math confuses you, please don't sweat it because most "normies" struggle with tax calculations. 😉)

Here’s what our 2026 income options look like after taxes:

Here in San Luis Potosi, Mexico those income amounts would go a long way. Most FIRE'd frugalistas that I know in the U.S. could make those income amounts go a long way.

Final Thoughts

Now that we have our 2026 FM! tax numbers, we are ready to make informed tax decisions for the upcoming tax year. As always, I have included tax tables to help my readers as they devise their own tax plan; see below.

Yours in 2026 tax preparedness,

Gerry

If you don’t have any children that qualify for the child tax credit and your filing status is “Single, MFS, or MFJ,” here’s your table:

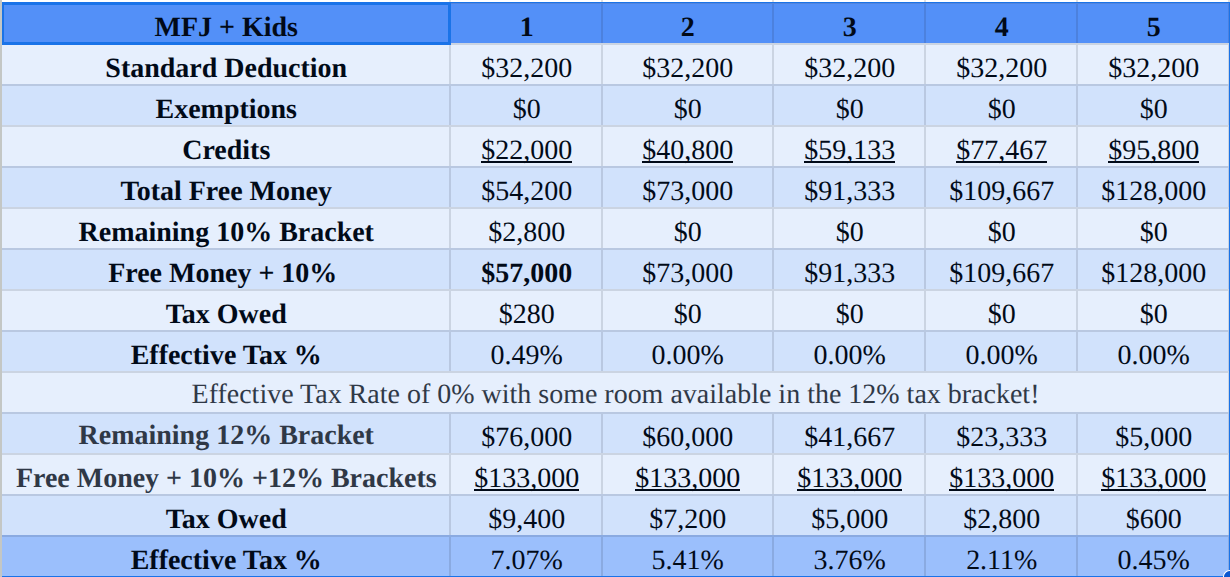

If you have children who qualify for the child tax credit and your filing status is “MFJ,” here’s your table:

If you have children who qualify for the child tax credit and your filing status is “Head of Household,” here’s your table:

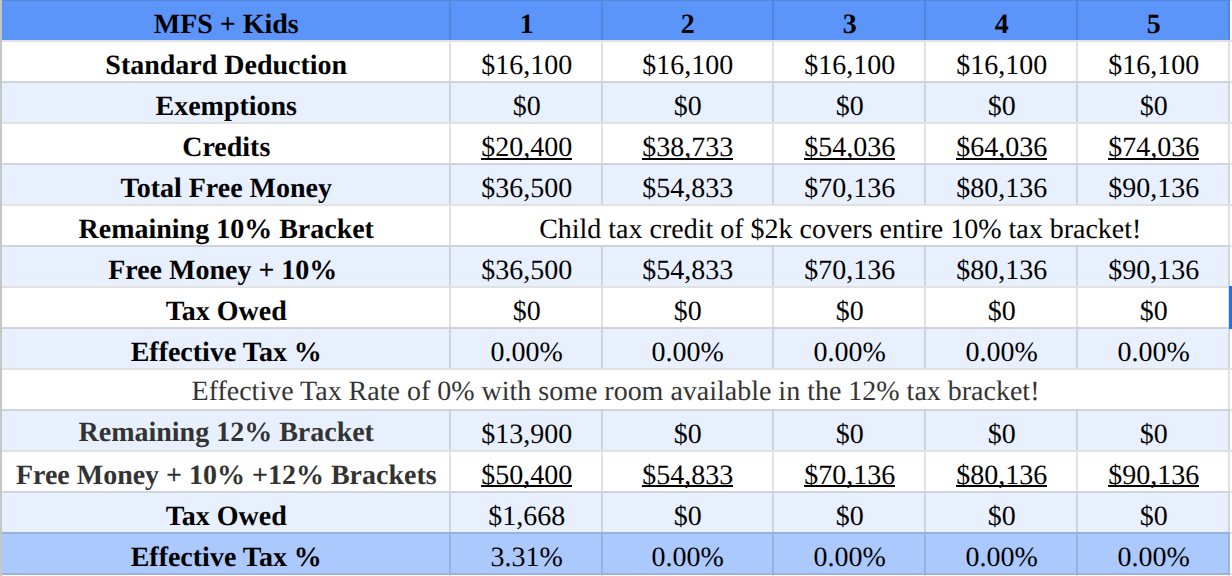

If you have children who qualify for the child tax credit and your filing status is “Married Filing Separately,” here’s your table: